Which of your ads are profitable?

Fewer than you think!

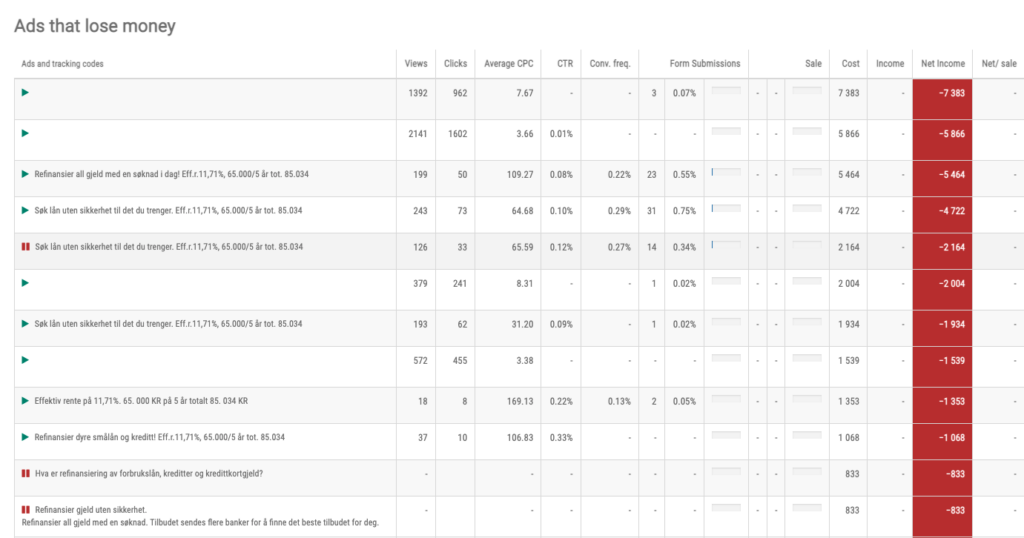

Most of your ads are not profitable.

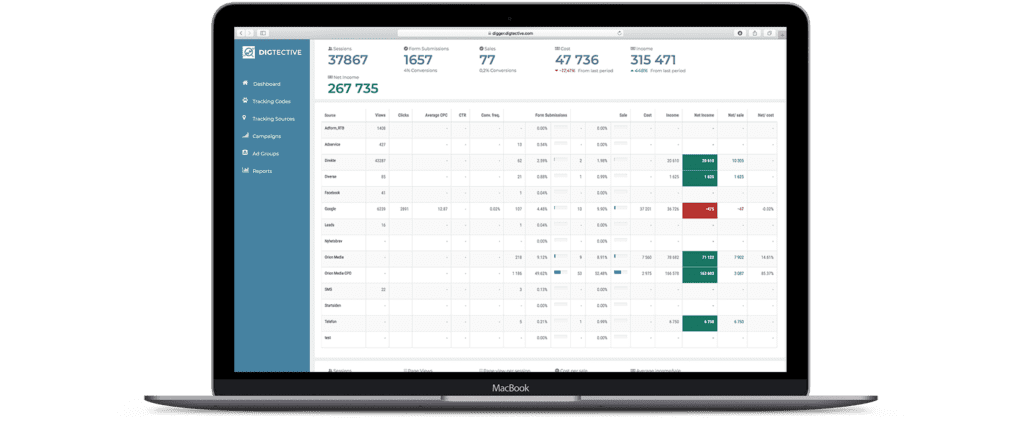

Over the last few years, Digtective has tracked over a million conversions using our server-side, cookieless tool. Our clients range across several industries but concentrate on financial services and real estate. To celebrate hitting the magic million number, we’ve deep-dived into the data to see what we – and therefore you – can learn from it.

Most of our clients operate businesses with longer and more complex sales cycles than your typical online store, such as loan intermediation, real estate agencies, or consultancy businesses. This means that tracking conversion is more complicated than just seeing who clicked on an advert. After the customer has submitted an application form for a loan, for example, the application has to be forwarded to the appropriate bank, the bank has to consider the application, and only if the loan is approved and the customer accepts the terms, does the intermediary get paid. While this can be a matter of minutes, it can also be a matter of months. Digtective’s tracking of these offline conversions is essential to direct your advertising spend to the right ads.

Most of your conversions don’t make you any money.

You already know that no one clicks on most of your ads – click-through rates are usually low for most channels. Once they’ve clicked on your ad and come to your goal page, though, how many actually turn into revenue? Our numbers indicate that this varies between and within customer segments, but the average is 6.4%. The range is from 2,7% to 11,3%.

* Note that some clients have proprietary channels ranking in the top 10, which are therefore hidden in the table.

The segments with the highest ratio of conversion to income are those where the end customer’s sense of urgency is highest: one client is a chain of dentists, others are banks and loan brokers specializing in refinancing distressed borrowers. Searching for a dentist or an expensive last-resort-mortgage is clearly not something people do casually … the loan brokers with low conversion rates are those who are active in crowded markets such as credit cards and consumer loans. The variation within each category is also interesting, implying that the quality of your adverts, the target market you are addressing, or other factors are impacting it.

Another interesting finding is that, for most of our clients, the best source of leads is in fact direct. Table 2 (above) shows, for a selection of clients (all from the financial services sector), which lead sources have the highest net income per conversion (i.e. income from the transaction minus the cost of the advert or lead). No average has been calculated (since the clients all have different numbers of total lead sources) direct is clearly the top source. Table 3 shows this quite clearly when looking at the aggregate numbers across the whole sample of clients. This is true even for those whose brand names are not well known in their market, indicating that doing a good job on SEO is a very worthwhile effort.

From our perspective it is also interesting to see how much the ROI on advertising spend differs between clients. As for most SaaS companies, we know that there is great variability in how active our clients are in using our software. Unlike most SaaS companies, we can compare the frequency of logging in with the effectiveness of our product! Of the four clients whose data we have used for the two above tables, two are active users of the service, checking their ads daily and cutting those which are not profitable. The other two have been more passive, allowing us to track their conversions without actively going in to focus their spending on effective ads. This is clearly visible in what return they are getting on their advertising spend:

The numbers you see in your analytics aren’t the full picture

The growth of ad-blockers and “do not track” means that Google Ads is missing more and more of your traffic and conversions. In addition, the use of cookies is becoming more and more difficult. Because our tool counts form submissions server-side, we can track those customers whose browsers do not allow cookies (while still being GDPR and privacy-compliant by avoiding the association of the conversion to any personal data about the customer). Over time, we have seen a significant gap between form submissions as counted by Google Ads, versus the full picture which our tool gives:

This indicates that Google Ads misses a huge number of conversions. This is of course an issue for those wanting accurate data to guide their advertising, but is an even bigger problem for those trying to create machine learning algorithms to automate this process.

What’s even worse is that many clients set up their Google Ads to track many different actions as a conversion – which is fine if you want to measure the performance of your webpages, but not if you’re looking to maximise your revenue. Defining “Youtube channel subscription” as a conversion will help you grow your YouTube channel, but will give you a very noisy dataset. As Cassie Kozyrkov says, the essence of ML and AI is “Optimize [this goal] on [this dataset]” – if your dataset is missing 30% of the full picture, or if the goal is unclear, you’re likely to end up with a bad algorithm. This has been adjusted for in the above table for Client C, which has a very broad definition of conversions in their Google set-up.

How we are developing our tool in response

The core of Digtective’s offering has been the Digger tool to track ad spend and profitability, reducing cost per lead and allowing you to focus your spending on the ads which perform best. However, as the death of the cookie and the growth of no-track has progressed, we have seen that we can provide an important service also to clients who just want to have accurate data in their analytics solution. We have therefore developed a service which feeds our conversion tracking back into Google Ads, allowing you to see the full quality of Digtective data in the interface you are already using. This also allows better training of any algorithms you may have for optimizing your ad spending.

To enable the widest possible adoption of this, we provided this in a “Digger Lite” subscription, where a monthly fee of EUR 50, rather than the full Digger subscription fee from EUR 1000. We are confident that seeing the true numbers will also increase interest in the full service, allowing more customers to reduce their marketing spend.

Big thanks to Jakob Bronebakk, CFA for his analysis. Jakob is an independent strategy consultant with a focus on using technology and data science to improve financial services.

Jakob was a cofounder of MyBank ASA, and served as its CFO and then CEO. He has held CFO positions in other financial services companies, prior to which he worked as a derivatives specialist at investment banks in London. His preferred habitat is steep, mountainous terrain, but can also be found in front of large spreadsheets or building machine learning models.

Learn more and reach out to Jakob on LinkedIn.